The geography of the PNW includes many bodies of water, marshlands and more. The high rates of rain many regions receive can cause those areas to overflow. What happens when a client’s dream home is in a flood zone? Below are some things to keep in mind along with resources that can help you out when it comes to flood insurance.

- Flood insurance is managed by FEMA (Federal Emergency Management Agency). Through FEMA, the maximum amount of insurance that can be obtained for a property is $250,000.

- 10% of that coverage will extend to a detached garage (if applicable), but it takes away from the overall amount of insurance. Meaning there would be $25,000 for the detached garage and $225,000 for the home.

- If you would like to help your client by providing them with an estimate of what their NFIP flood insurance would be, you can use this tool: D2C Quote Tool

- There’s a good chance that the property your client is interested in is valued significantly over $250,000. In this case, your clients will want to consider private flood insurance. Private flood insurance does not have the strict limitations on coverage like FEMA policies, and can often provide more robust coverage.

- Before making anything official, it’s important to consider if there have been any floods on the property within the last 10 years. A flood in the past 10 years can significantly impact the premium along with eligibility for coverage.

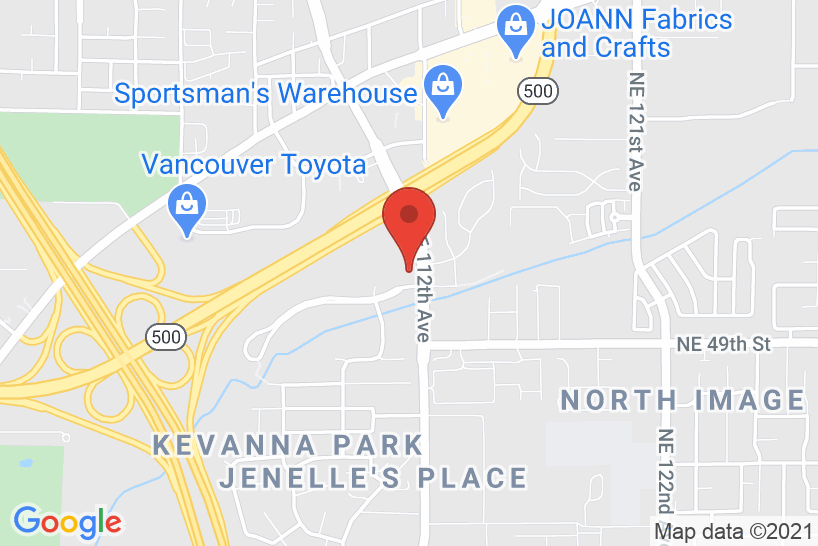

- If you’d like to see if a property your clients are considering has flooded in the last 10 years, please use our Insurance Rate Impact Report. We will look up historical claims, flood zone and fire protection class information and send it to you. You can also see if a property is in a “high-risk” flood zone here: https://msc.fema.gov/portal/search.

- If your clients want to control their flood insurance premiums, be sure to check for the maximum allowable deductible. Increasing the deductible will lower premium.

As your trusted independent insurance advisor, we want to save you and your client the headache that insurance issues could cause. We are versed in flood insurance and can shop across markets to offer the most competitive coverage and rates. Help your client protect their dream home by making them aware of the perils of the PNW – and send them our way so we can get them the best coverage that’s right for them.